As blockchain gaming shall continue its evolution at the breakneck speed, B3 (Base) assumed the position of a potential game-changer within the Layer 3 ecosystem. Solely catering to hassle-free user experience, game interoperability, and developer empowerment, B3 is luring the attention of both avid gamers and crypto investors. However, with a plethora of options in the Web3 world, we might wonder if B3 will have a sustainable future and whether its token will keep on going up in value.

What Is So Different About B3?

B3 is not only a gaming token, but it is a complete infrastructure solution that is designed on Base, a Layer 2 blockchain that leads the way. B3, by the help of Layer 3 technology, lowers the fees for transactions done on Base and increases the throughput significantly. Such a method opens the way for fully on-chain games that are both scalable, and commercially viable, which is a big deal, as the Web3 gaming sector has been suffering this problem for a very long time.

B3’s Open Gaming Ecosystem is one of its unique aspects. With this, players can transfer game assets to other titles, use the liquidity, and partake in incentives of multiple games simultaneously. Moreover, Basement.fun, B3’s discovery platform, is the catalyst of this ecosystem as it gives developers the exposure they need and it is quite convenient for the players to locate new Web3 games.

On top of the user experience, B3 utilizes a technology, called chain abstraction, which makes it quite unique. The players can log in once and get access to assets in diverse games, thus, there is no need to manage numerous wallets or use bridges. This absolutely zero friction method of onboarding is really important for the adoption at a large scale, especially so, when the line between Web2 and Web3 games is barely visible.

Developers can enjoy the benefit of B3 which supplies them the tremendous support- SDKs, marketing tools, and infrastructure- all of which contribute to lowering the barrier of entry and promoting new ideas. Moreover, the protocol implements a revenue-sharing model that evokes the image of big Web2 gaming publishers, which is money invested in new ventures, and in turn, sharing the profits with them.

B3 Tokenomics and Circulation

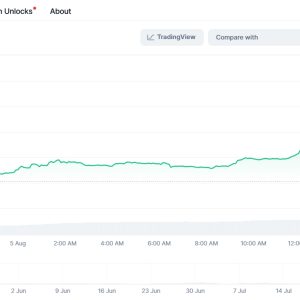

Just after the Token Generation Event, B3 will unlock some of its supply, and the rest will follow a planned vesting schedule. Such a gradual release is aimed at balancing the availability of assets with the ecosystem’s long-term stability, thus, alleviating the risk of too much early selling pressure and at the same time, providing rewards to the ecosystem contributors and to investors.

B3’s need is far more than token speculation. The token is at the center of decision making, in-game transactions as well as developer services, and staking for community rewards. These comprehensive applications can lead to the creation of genuine demand for B3 and thus, the token can be considered a major network asset.

Foundational Strength

B3 is the creation of Player1 Foundation, a team of blockchain engineers, gaming veterans, and crypto experts with a strong track record. This mix of technical and industry knowledge enables B3 to calmly make its way through the competition of the Web3 gaming market and have foresight.

Will B3 Rise? Price Outlook

B3’s potential price rise is dependent to a great extent on the go-to of its ecosystem. The more developers are willing to put their games on the Open Gaming network and the more players are inclined to use Basement.fun, the higher will $B3’s natural demand be.

B3’s non-fungible features such as shared liquidity and GameChains (studio-specific Layer 3 networks that are customizable) not only improve but also present the strong network effects. The launch of new games and the influx of users will, in turn, increase the demand for B3 tokens required for governance, purchases, and staking.

Thus, like every{‘ ‘}other emerging token, the price path of B3 will be subjected to volatility. Initial unlocks along with liquidity events can lead to fluctuations, particularly in the short term. But along with the persistent network expansion, the rise of TVL (Total Value Locked), and ecosystem engagement over time, the trend of the price will most probably be a sustainable one.

Key Factors to Watch

- Developer and player adoption: That is to say, the more games and users B3 manages to onboard, the more tokenomics B3 will have.

- Onboarding experience: B3’s utterly smooth login and wallet abstraction are the main factors enticing mainstream gamers.

- Partnerships and integrations: The strategic partnerships with studios at the forefront of innovation or brands in the gaming industry can propel token usage and adoption.

- Ecosystem rewards: The successful staking and incentive programs will be instrumental in retaining users as well as maintaining the demand/supply of the token at a healthy level.

Analyst Conclusion: Does B3 Have a Future?

A future for B3 that is favorable is what all indicators are pointing at. B3 is not merely a speculative asset as it is tackling the issues in the sector one after another—interoperability, user onboarding, and developer support. Its technology is the platform for the entire new onchain gaming, and its business model offers growth incentives that align the interests of players, developers, and investors all at once.

The journey might not be devoid of unstable market conditions, but it cannot be denied that B3 is one of the leading projects in the decentralized gaming sector. Those who put money into it may want to monitor carefully various aspects such as the achievement of the ecosystem’s goals, the growth of the community, and the number of developers who are attracted by the platform. It is possible that the potential of B3 and consequently the value of its token will shine in the case these basic factors keep progressing.