In today’s fast-moving digital world, finding a financial news platform that actually delivers value—not noise—is harder than it should be. Many websites either lean heavily into sensationalism or serve as thinly veiled advertising engines. So, when I stumbled upon FintechZoom.com, I wasn’t expecting anything out of the ordinary. But after weeks of revisiting it, reading through its articles and using its tools, I can say this: FintechZoom has found a place in my rotation—not because it’s flashy, but because it’s surprisingly grounded.

What Is FintechZoom?

FintechZoom is a digital news and media platform that focuses on financial technology (fintech), global markets, crypto, banking, and personal finance. It sits at the intersection of traditional finance and modern innovation, often covering topics that many mainstream business media outlets overlook—especially when it comes to crypto updates, decentralized finance (DeFi), and emerging tech news.

But what makes FintechZoom different isn’t just the topics it covers—it’s how it covers them.

A Blend of Editorial and Informational

FintechZoom articles are straightforward. They don’t talk down to the reader, and they don’t try too hard to impress. This is a double-edged sword. On one hand, the content is easy to digest, especially for readers who aren’t financial analysts or fintech insiders. On the other, some might find the writing style too minimal, even basic at times. But in a world saturated with clickbait, that restraint feels refreshing.

They regularly feature content around:

- Cryptocurrency trends and forecasts

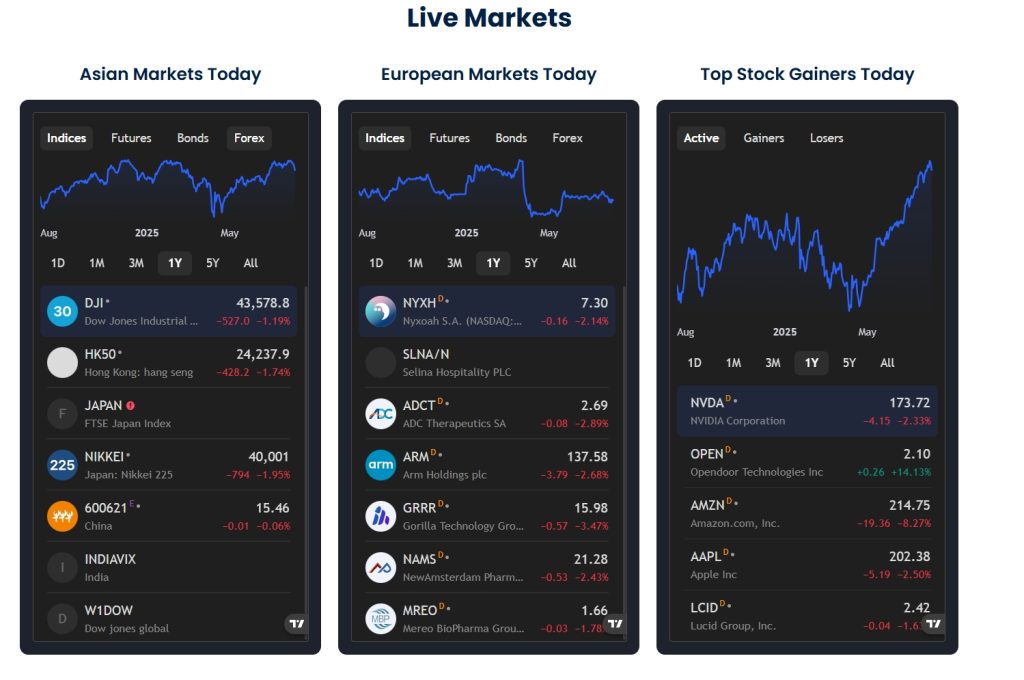

- Stock market updates

- Insights into major companies like Tesla, Apple, Amazon

- Updates on interest rates, inflation, and macroeconomic shifts

- Guides on platforms like PayPal, Robinhood, Cash App

What’s particularly useful is their tendency to mix evergreen content—such as “how to use Venmo securely”—with real-time market reactions, like price movements in Bitcoin or breaking fintech mergers.

The UX: Clean, If Not Perfect

The website itself is functional and uncluttered, which I appreciate. No overwhelming pop-ups. Ads exist, but they don’t dominate the reading experience. Navigation is intuitive, with categories clearly marked and recent articles easy to find.

That said, the site can feel a bit too templated at times. You’ll see repeating layouts across different posts, and some of the content can feel recycled—especially company-based forecasts or product overviews. For daily readers, this might reduce the sense of freshness.

But for someone checking in a few times a week? It does the job well.

Is FintechZoom Trustworthy?

Here’s where it gets interesting. FintechZoom isn’t trying to compete with Bloomberg or Reuters. It doesn’t pretend to be Wall Street’s definitive voice. Instead, it positions itself as a resource for people who want concise, casual, and moderately opinionated takes on current financial topics.

You won’t find deep investigative journalism here. But you will find relevant updates that are useful to retail investors, tech-savvy readers, and crypto-curious audiences. When they make predictions, they don’t present them as fact. When they explore rumors (say, about a company’s stock split or a crypto rally), they usually label it as speculation. That kind of transparency matters.

Who Is It For?

If you’re the type of reader who’s constantly jumping between CNBC, CoinDesk, and Twitter threads, FintechZoom may feel a bit light for your taste. But if you’re someone who just wants a fast, readable snapshot of what’s happening in finance and tech, without wading through jargon and 2000-word op-eds, it’s a very solid option.

It’s also a great reference point for small investors, casual readers, and even content creators who need a pulse check on popular fintech narratives.

Final Thoughts

FintechZoom.com isn’t perfect—but it’s surprisingly practical.

It doesn’t try to be the loudest voice in the room. It doesn’t pretend to be the most technical. What it offers is consistency, clarity, and a curated stream of information that’s easy to consume.

In a noisy world of finance content, that alone is worth bookmarking.