MYX Finance Hits New All-Time High – What’s Next for MYX Price?

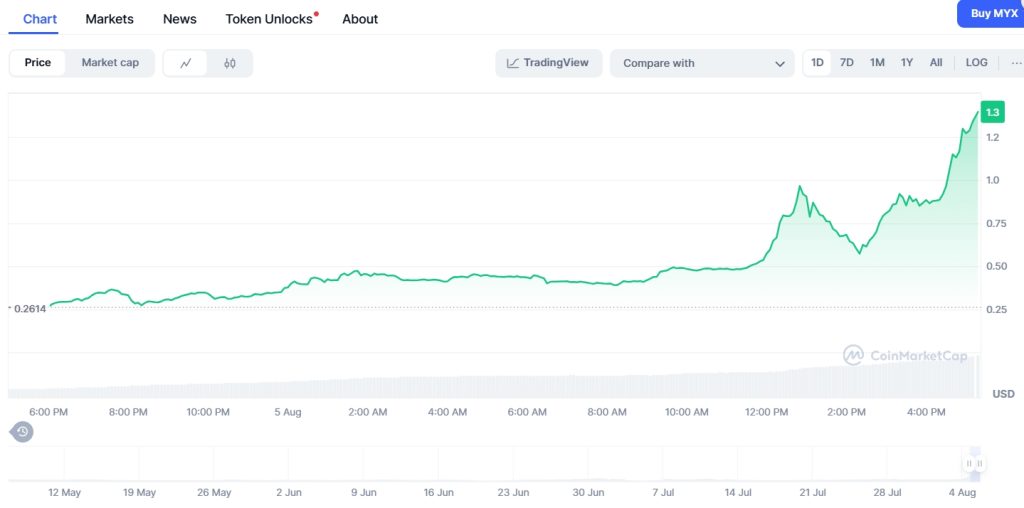

The native token of MYX Finance, a non-custodial derivatives exchange, is making waves across the crypto landscape. After notching a new all-time high, MYX has posted a staggering 300% gain over the last month, with a blistering 90% rally in just the past day. Now trading around $0.24, MYX is attracting significant attention from both seasoned traders and newcomers alike. But with so much momentum in the rearview mirror, the question becomes: Can this run continue, or is a cooldown around the corner?

Technical Breakout Signals Bullish Control

Looking at the 4-hour chart, MYX’s recent surge is far from random. The token powered past resistance at $0.16 and didn’t stop until it had left a well-defined symmetrical triangle pattern in the dust. These triangles typically represent a standoff between bulls and bears, but the recent breakout left little doubt about who’s steering the ship right now.

The strength behind the move is further confirmed by the Bull Bear Power indicator, which continues to push to new highs—clear evidence that buyers are firmly in control. MYX managed to hold a crucial support zone near $0.097 during the consolidation, and once that base was established, it was off to the races.

The Chaikin Money Flow tells a similar story. Not long ago, MYX was languishing with the CMF in negative territory, reflecting more selling than buying. Today, however, the reading has climbed deep into positive territory, signaling that accumulation is outpacing distribution. This kind of sustained buying interest is what often underpins moves to new highs.

Volume and On-Chain Activity Hit Milestones

Volume has been another critical piece of the puzzle. In the past 24 hours, trading activity in MYX has exploded, with millions in volume changing hands—a dramatic uptick that adds weight to the price action. Over the past week, total trading volume has reached levels rarely seen for this asset, showing just how many participants are getting involved.

This surge in activity isn’t just speculative, either. On-chain data shows a sharp increase in token transactions, and total value locked (TVL) on the platform has broken into fresh territory. Both are strong signs of growing engagement and real demand for the underlying platform.

With both volume and TVL trending higher, and price following suit, MYX looks well-positioned to continue its climb—at least in the short term. If this pace keeps up, the door could open for a push above $0.30.

Short-Term Price Outlook: Still Bullish, But Caution Warranted

Zooming out to the daily timeframe, the bullish tone remains. The chart is showing consecutive bullish engulfing candles, a classic signal of strong buying interest. The MACD indicator, meanwhile, has flipped to a bullish crossover, reinforcing the positive momentum.

As long as this technical strength holds and profit-taking doesn’t accelerate, there’s every reason to believe MYX could attempt another leg higher, with a potential target around $0.36 if the stars align.

Of course, crypto markets have a way of humbling even the most confident traders. A sudden bout of profit-taking or a broader risk-off move could spark a correction, with $0.17 serving as a potential support level if the rally stumbles.

Bottom Line

MYX is riding a powerful wave of momentum, and for now, buyers remain firmly in charge. As always in crypto, risk management is essential. Traders should keep a close eye on volume, momentum indicators, and support levels in the days ahead.

Whether this breakout marks the beginning of a sustained bull run or is a prelude to a sharp retracement, one thing’s clear: MYX Finance is a token to watch closely as the next chapter unfolds.