Honestly? I\’m tired. Bone-tired of pretending crypto investing is some exhilarating rollercoaster when most days it feels like watching paint dry while someone periodically kicks the can down the road. Passive income. Ha. Remember 2022? I do. Vividly. Sitting there with my \”diversified\” portfolio of blue-chip tokens bleeding out like stuck pigs while Celsius froze withdrawals. That metallic taste of panic? Yeah, that wasn\’t in the brochure. I’d cobbled together some DeFi yield farms myself – felt clever for about five minutes until an obscure token in the liquidity pool rug-pulled, vaporizing 30% overnight. Passive my ass. More like passive-aggressive financial suicide.

That’s when Toros Finance drifted onto my radar. Not through some hyped Twitter thread, but because a guy I vaguely trust – Dan, who actually reads smart contracts for fun – muttered about it over terrible conference coffee. \”They don’t promise moonshots,\” he’d said, rubbing his eyes. \”Just… less ways to accidentally light your money on fire.\” Sounded suspiciously like adult supervision. My skepticism was thick. Another platform? Another layer of complexity between me and my already-opaque crypto assets? Please. But desperation breeds openness, or maybe just exhaustion.

So I poked around. First thing that struck me wasn’t the fancy APY projections (they barely advertise those, weirdly), but the sheer, boring weight of their security setup. Multi-party computation (MPC) vaults. Meaning my keys weren’t just held by Toros or me alone, but sharded. Requires multiple approvals for movement. Like a bank vault needing three separate keys turned simultaneously. Remember Mt. Gox? Yeah. This felt… different. Cold storage dominance too – over 95% of assets offline, away from hot wallet honeypots. It wasn’t sexy. It was plumbing. But after years of leaky pipes flooding the basement, sturdy plumbing starts looking damn appealing.

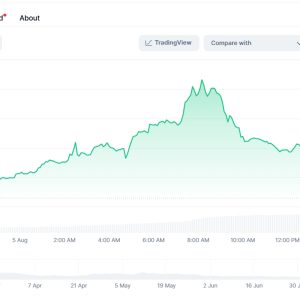

Then came the actual \”passive\” part. Their structured products. Not the wild, leveraged junk, but things like automated delta-neutral strategies. Here’s where my own cynicism got a reality check. During that brutal sideways chop last October – you know, when Bitcoin couldn’t decide if it wanted to be a store of value or a pet rock – I threw a small, \”disposable\” chunk into their ETH Yield Optimizer. Expected maybe… nothing. Flatline. Instead? Tiny, incremental upticks. Daily. Like watching moss grow, but moss that paid rent. No 1000% APY nonsense. Just a stubborn 7-12% APY, grinding upwards even when the market felt comatose. It felt less like gambling and more like… owning a vending machine in a decently trafficked hallway. Unspectacular. Reliable. Weirdly comforting.

But here’s the rub, the human contradiction they don’t tell you about in onboarding videos: Even with the robust security, the steady returns… I still check. Constantly. The trauma of past exits scams and exchange implosions runs deep. That little voice whispers, \”What if this is the clever long con?\” Toros publishes their audits (Chainalysis, Halborn – serious names), their proof-of-reserves feels less like theatre than others… and yet. That ingrained paranoia doesn’t vanish. It just mutates. Now it’s less \”Will they steal everything?\” and more \”Will their fancy algorithms just… stop working tomorrow?\” The fatigue isn’t just from losses; it’s from the perpetual vigilance required just to feel slightly safe. Toros lessens the load, but doesn’t remove it. Not in crypto. Never in crypto.

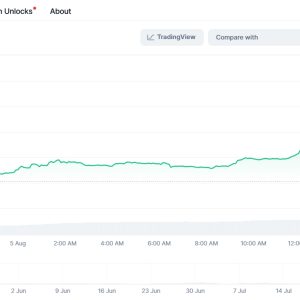

And the automation? God, it’s a double-edged sword. Setting up recurring DCA into their crypto index product felt like surrender. Like admitting I couldn’t time the market (because I can\’t). Watching it buy the bloody dip automatically last month while I was doom-scrolling news about bank failures… it felt alien. Efficient, but detached. Like outsourcing a piece of your financial heartbeat to a very calm, very methodical robot. There’s relief, sure. No emotional binge-buying FOMO or panic-selling at 3 AM. But also… a weird disconnection. A loss of that addicting, masochistic thrill. Sometimes I miss the self-inflicted chaos. Almost.

Would I shove my life savings into Toros? Hell no. That’s not wisdom; it’s the scar tissue talking. But for the chunk I’ve allocated to \”crypto exposure I don’t want to actively babysit\”? It’s become the least stressful corner of my portfolio. It’s not exciting. It won’t make me rich next week. But after years of feeling like a lab rat in a volatility experiment, boring feels like a radical act of self-preservation. Toros hasn’t made me love crypto again. But it’s made passive investing feel slightly less like an oxymoron. Slightly.

【FAQ】