Man, another \”low risk high return\” crypto pitch landed in my inbox this morning. RCO Finance. RCOF tokens. The usual buzzwords: AI-driven, presale discounts, staking rewards, deflationary magic. My first reaction? A deep sigh. Seriously. Feels like I’ve danced this tired tango a hundred times since 2017. LUNA promised the moon, Celsius felt like a cozy bank, Anchor Protocol offered that sweet, sweet 20% APY… and look how those turned out. My gut churns a little remembering the sickening dip on my portfolio charts when those imploded. So yeah, pardon the skepticism if I don’t immediately strap on my moon boots for RCOF.

But… curiosity’s a bitch, right? And the bills don’t pay themselves. So I dug. Again. RCO Finance isn’t just another meme coin circus, gotta give ’em that. They’re actually trying to build something resembling a DeFi toolbox. AI for market analysis? Okay, heard that before, but the pitch is smoother. Automated trading strategies? Sounds like every bot service ever, but integrated into their platform. Tokenizing real-world assets? Now that pricked my ears up. Remember trying to get exposure to commercial real estate back in ’21? The paperwork alone nearly killed me. If RCOF can genuinely streamline that mess… maybe there’s a sliver of something here. But \”seamless\”? Ha. I’ll believe it when I see it, not when I read it in a glossy whitepaper.

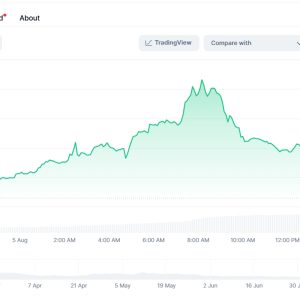

Let’s talk about the big shiny lure: the presale. Stage 1 at $0.0127, Stage 2 jumps to $0.0343. The math screams \”buy early, dummy!\” They claim a potential 3000% return for the earliest birds if it hits their projected $0.4 – $0.6 listing price. My inner cynic scoffs. My inner gambler? He’s doing frantic calculations on a napkin. I remember the frantic rush of Chainlink’s presale, the sheer disbelief as it climbed. And the crushing regret of ignoring Solana’s early dirt-cheap prices because I thought \”another Ethereum killer? Yeah right.\” FOMO is a powerful drug. So, cautiously, I allocated a sliver. Not the rent money. Not even the \”nice dinner out\” money. More like the \”if this vanishes, I’ll just eat instant noodles for a week\” money. It’s the crypto tax for potentially sleeping better later. Maybe.

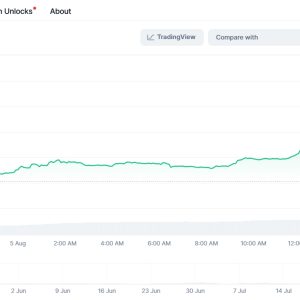

Staking rewards. The 42% APY headline is pure dopamine. Makes you forget the 8% your bank offers is actually pathetic. But then reality kicks in. Locking periods. Impermanent loss whispers from the corner. Platform risk – what if their smart contract has a hole someone drives a truck through? Remember Poly Network? Yeah. That $600M oopsie. So, I dipped a toe in. Small bag staked. Watching the rewards trickle in feels… okay. Nice, even. But that 42%? It’s promotional. It will drop. Probably plummet once more people pile in or the market inevitably does its usual chaotic wobble. It’s not free money. It’s payment for taking on risk and locking your assets away. Treat it like a side hustle, not a salary.

The deflationary model. Burning tokens with transactions. Sounds great on paper. Scarcity drives value! Basic economics! But then you look at the sheer volume needed to make a dent. Billions of tokens in circulation. How many transactions? How much actual burn? It feels… theoretical. Like hoping a single ice cube will cool down a volcano. Maybe, over years, it adds up. Maybe. But counting on this as the primary driver for massive price appreciation? Feels like building a sandcastle right at the high tide line. I’ve seen too many \”burn mechanisms\” that ended up being little more than a marketing gimmick when volume dried up.

Risk management. They talk a good game. Diversification tools, AI risk assessment. But let’s be brutally honest here: minimal risk in crypto is an oxymoron. It’s like \”military intelligence\” or \”jumbo shrimp.\” Doesn’t really exist. The only minimal risk strategy is not playing. Period. Everything else is degrees of potential pain. What RCO Finance might offer is slightly more sophisticated tools to manage that inherent risk. Automated stop-losses? Helpful, until a flash crash triggers it and the price instantly recovers. Portfolio rebalancing? Great, unless the AI model is trained on bull market data and flails wildly in a bear. I’m using their tools, sure. But I’m double-checking everything. Constantly. My own spreadsheets are still open. Trust, but verify. Mostly verify.

Honestly? The \”potential returns\” feel… possible. Maybe even plausible. But not probable, and definitely not guaranteed. My tiny presale allocation is up on paper. Cool. My staking rewards are accumulating. Nice. But the gnawing anxiety hasn\’t vanished. It never does. Every time I log into their platform (which is… fine? A bit clunky sometimes?), I’m half-expecting to see a \”Maintenance\” screen that never ends. Or news of an exploit. Or just the whole damn market deciding to take another nosedive for no good reason. Which it does. Regularly. The potential is there, shimmering. But it’s surrounded by a minefield of \”what ifs.\”

Would I bet my life savings on RCOF delivering generational wealth with minimal risk? Hell no. That’s a fairy tale sold to rubes. But would I allocate a small, strictly defined portion of my speculative portfolio to it, understanding it could go to zero? Yeah. I did. Because the alternative – sitting entirely on the sidelines watching another potential wave crest while I cling to my stablecoins earning inflation-adjusted losses – feels equally crappy. It’s not about achieving high profits with minimal risk. That’s marketing fluff. It’s about finding a project with some substance, some utility beyond pure hype, and taking a calculated gamble with money I can genuinely afford to light on fire. RCO Finance, right now, ticks enough boxes for me to hold my nose and throw a little fuel on that fire. Ask me again in six months. I might just be sighing even deeper.