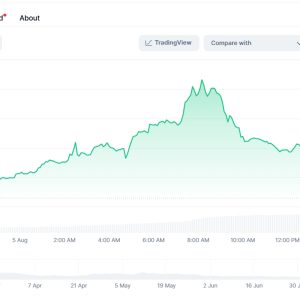

Man, I\’ve been deep in this crypto rabbit hole for what feels like forever, and honestly? The whole gas fee nightmare on Ethereum just wears me down. Like, remember last month? I was trying to send a hundred bucks worth of ETH to my buddy for his birthday gift—nothing fancy, just a quick transfer. But on Ethereum mainnet, the fee shot up to like $40 at one point. Forty bucks! For moving a hundred? That\’s insane, right? I sat there staring at Metamask, coffee cold beside me, feeling this wave of frustration. Why does it have to be so damn expensive? I mean, crypto was supposed to be this liberating thing, but sometimes it just feels like a rigged game where the house always wins. And yeah, I know people say \”just be patient\” or \”it\’s the price of decentralization,\” but come on—when you\’re just trying to do something simple, it grinds you down.

So, that\’s how I ended up poking around Polygon. Or Matic, whatever—names change, but the idea stuck. A friend of mine, Sarah, she\’s been into DeFi for ages, and she messaged me out of the blue one Tuesday night. \”Dude, try the Polygon bridge,\” she said. \”I sent USDT for less than a cent, and it was done in seconds.\” At first, I was skeptical. Like, really? Another Layer 2 solution? I\’d tried Optimism and Arbitrum before, and they were okay, but setup was a hassle. Plus, with crypto, every new thing feels like a gamble—you never know if it\’s legit or some rug pull waiting to happen. But I was desperate. That same week, I\’d wasted hours refreshing gas trackers, feeling like an idiot. So, I gave it a shot. Downloaded the Polygon wallet extension, connected it to Metamask, and… wow. The interface was cleaner than I expected. Still, my hands were a bit shaky. What if I messed up the address? What if the bridge ate my funds? Crypto horror stories flash through your mind, you know?

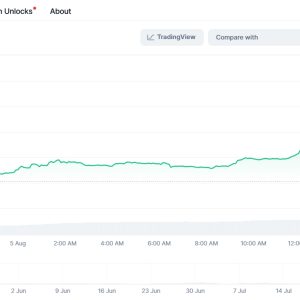

Anyway, I went through with it. Used the PoS bridge—that\’s Proof of Stake, I think—to move some ETH over. The process? Not flawless, I\’ll admit. Had to approve a bunch of transactions, sign off on permissions, and at one point, Metamask glitched out. My heart sank. Thought I\’d lost it all. But after a minute of panic, refreshing the page, it popped up: transfer complete. Total fee? Less than a penny. Time? Maybe 30 seconds. I just sat back in my chair, half-laughing, half-exhausted. Relief mixed with this weird disbelief. Like, why isn\’t everyone using this? But then, the doubts creep in. Is Polygon really that great, or am I just tired of the alternatives? I mean, it\’s built on Ethereum, so it\’s not some standalone magic—more like a shortcut that offloads traffic to sidechains. And yeah, it\’s fast and cheap, but what about security? I\’ve read stuff about bridge hacks—remember the Wormhole exploit? Millions gone in a flash. Makes you pause. So now, when I use it, I do small amounts first. Test the waters. Last week, I bridged $50 worth of MATIC tokens to stake in a pool. Smooth as butter, fee negligible. But I still double-check everything. Trust issues, I guess.

Digging deeper, though, it\’s not all sunshine. Polygon bridges work by locking your assets on Ethereum and minting equivalents on Polygon\’s chain. Sounds straightforward, but in practice? There are quirks. Like, the first time I tried bridging USDC, I didn\’t realize I needed to wrap it or something. Ended up with tokens stuck in limbo for a day. Had to Google-fu my way through forums, find some obscure tutorial. Felt like a noob all over again. And the whole experience highlights this tension in crypto: we chase efficiency, but at what cost? Polygon\’s validators are fewer than Ethereum\’s, so it\’s more centralized. That bugs me. I value decentralization—it\’s why I got into crypto in the first place—but when fees hit $50 for a simple swap, principles start to bend. I find myself thinking, \”Just this once, for the speed.\” But then I feel guilty. Like I\’m betraying the ethos. Stupid, right? Human emotions are messy. On a brighter note, I used the bridge to send funds to an exchange last month for a quick trade. Saved me a bundle. But even that had a hiccup: the exchange took longer to credit it because their Polygon integration was slow. So, fast bridge, slow endpoint. Irony.

Comparing it to other options adds layers. Like, I tried Avalanche bridge once—similar idea, low fees. But setup was clunkier, and I lost funds in a user error. With Polygon, the ecosystem feels more mature. DApps like QuickSwap or Aave are integrated, so bridging in lets you dive into farming or lending without redoing everything. That\’s a win. But here\’s the thing: it\’s not foolproof. Security audits help, but bridges are hot targets. I read about Poly Network\’s hack—$600 million stolen—and it sends shivers. So now, I only bridge what I can afford to lose. Small amounts, like $20 here and there. And I time it: late at night, when networks are quieter, to avoid congestion. But even then, there\’s this underlying fatigue. Crypto was supposed to simplify life, but it often complicates it. I\’m sitting here now, typing this at 2 AM, because I just bridged some ETH for a NFT purchase. Fee was $0.001, done in a blink. But I\’m drained. The constant vigilance—checking block explorers, confirming receipts—it wears on you. Makes me wonder if I\’m just trading one stress for another.

Real-world examples stick with me. Like, that time in December when I helped my cousin send remittance to family overseas. He\’s not tech-savvy, so I walked him through Polygon bridge. We used USDC for stability. Fee? Pennies. Transfer? Instant. His relief was palpable—no Western Union fees, no bank delays. But then, halfway through, his internet dropped. We freaked out, thinking the transaction failed. It hadn\’t; it was fine. But that moment of uncertainty? It captures the whole experience. You gain speed and savings, but lose a bit of peace of mind. And for all its perks, Polygon isn\’t perfect. The bridge UI updates, and sometimes buttons move—minor annoyances that add up. Or the fact that withdrawing back to Ethereum can take longer, with higher fees if you\’re not careful. I did that once: bridged MATIC back, and it cost me $5 in gas because I picked a busy time. Lesson learned. Now, I leave most assets on Polygon unless I really need them on mainnet. It\’s a balancing act. Part of me loves it; part of me resents the dependency. Like, why can\’t Ethereum just fix itself? But hey, that\’s the game. Adapt or get left behind.

So where does that leave me? Still using Polygon bridges regularly, I guess. For quick swaps, small transfers, it\’s a lifesaver. But with each use, I\’m reminded of the trade-offs. The speed is addictive—once you taste sub-second confirmations, waiting for Ethereum feels archaic. Yet, I can\’t shake the unease. What if a vulnerability pops up? What if the team behind it changes direction? I\’m not all-in; I diversify. Keep some funds on-chain, some on Layer 2s. And honestly, the emotional rollercoaster is real. One day, I\’m elated saving $30 on fees. The next, I\’m paranoid after reading a Reddit thread about bridge risks. It\’s exhausting, but that\’s crypto. For now, I\’ll keep bridging when it makes sense. But man, I need a break. Maybe just HODL for a while. Or not. Who knows? The fatigue\’s setting in as I write this—eyes heavy, brain foggy. But I\’ll hit publish anyway. Because sharing this mess feels… cathartic. Or maybe just necessary.

【FAQ】

What exactly is a Polygon bridge? Well, from my experience, it\’s a tool that lets you move crypto assets—like ETH or tokens—between Ethereum\’s main blockchain and Polygon\’s sidechain. Think of it as a digital ferry: you lock your coins on one side, and they appear as equivalents on the other almost instantly. I used it last week to transfer USDC, and it cost me less than a cent. But it\’s not magic; you need compatible wallets like Metamask set up for both networks.

How do I actually use a Polygon bridge? Okay, first, you\’ll need a wallet connected to Polygon (I use Metamask with the Polygon network added). Then, head to the official bridge site—like the Polygon PoS Bridge. Select your asset, enter the amount, and confirm the transactions. I remember my first try: I forgot to approve the token first, so it failed. Had to redo it. Fees are super low, but double-check addresses to avoid sending to the wrong place—lost a small amount once that way.

Is using a Polygon bridge safe? Hmm, it\’s relatively secure based on audits, but not risk-free. I\’ve had smooth transfers, but I\’ve also read about hacks like the one on Wormhole. Personally, I only bridge small sums and use trusted links to avoid phishing. Security feels okay for daily use, but I wouldn\’t move life savings through it—always a chance of exploits or user errors.

What are the fees like for Polygon bridges? They\’re crazy low—usually fractions of a cent, compared to Ethereum\’s dollars. For example, when I bridged MATIC tokens last month, the fee was $0.0005. But withdrawing back to Ethereum can cost more if gas is high; I paid $5 once during peak times. So, it\’s cheap for entering Polygon, but exiting might sting.

Are there any risks I should watch out for? Yeah, definitely. Bridge vulnerabilities are a big one—I stay updated on news. Also, network congestion can slow things down occasionally, and if you mess up the setup (like wrong chain selection), funds could get stuck. I learned to test with tiny amounts first. Plus, Polygon\’s centralization means fewer validators, which adds a trust element. Not ideal, but for speed, I tolerate it.