So you\’ve got some Stake tokens rattling around in your digital wallet – maybe from playing those Stake Originals, maybe from a friend sending you beer money in crypto, maybe just sitting there like a weird digital souvenir from that phase where you thought every altcoin would moon. And now? Now you actually want, like, dollars. Real ones. The kind that buy groceries, pay the electric bill that just landed with a thud, or maybe just fund a guilt-free takeout night because cooking feels like climbing Everest after that Monday. I get it. Been there, staring at the balance, wondering how the hell to turn these internet points into actual cash I can shove into my actual, slightly worn-out wallet. It feels… opaque. Annoying. Like there\’s gotta be a catch, right?

Let me tell you about the first time I tried cashing out a small Stake win. Nothing crazy, maybe $80 worth. Felt like free money! Euphoria! Then came the reality check. Found an exchange. Sent the tokens. Watched the network fee gnaw a chunk off it immediately. Then the exchange itself took its cut. The quoted price? Pure fantasy. By the time it landed in my USD account? More like $62. The feeling wasn\’t triumph; it was a deflated \”Oh. Well, that sucks.\” It wasn\’t the exchange being evil, necessarily. It was me being clueless about the friction points – the silent costs of moving from crypto-land to the land of direct debits and contactless payments. That $18 sting taught me more than any slick \”How to Cash Out\” video ever could.

Alright, let\’s ditch the abstract. You wanna convert STAKE to USD. How does it actually work in the trenches? First, you gotta get your STAKE off the Stake platform itself. Unless you\’re using their card thing (which has its own rules and availability headaches), Stake.com isn\’t a fiat off-ramp. It\’s a casino, not a bank. So, step one: Withdraw your STAKE tokens. Sounds simple. Log in, hit withdraw, paste an address. But here’s where the tiny anxieties creep in. That address better be perfect. One typo? Poof. Gone. Forever. I triple-check, sweat slightly, then hit confirm. Then you wait. Blockchain time isn\’t human time. It feels glacial. Did it go through? Did I screw up? Refresh. Refresh again. That knot in your stomach? Yeah, standard issue.

Signing up is step one. Easy enough. Then comes the soul-crushing part: KYC (Know Your Customer). You will need to verify your identity. Passport, driver\’s license, sometimes even a selfie holding it like a hostage. It feels invasive. It is invasive. It takes time. Sometimes hours, sometimes days. You\’ll question why you\’re doing this for $50. You\’ll glare at the blurry photo your webcam insists on taking. This step alone makes small conversions feel utterly pointless. The friction is real and annoying as hell. Once verified? You deposit your STAKE from your wallet to your exchange wallet. More address copying. More sweating. More waiting.

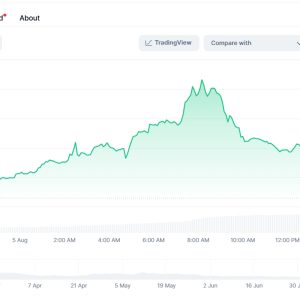

Tokens finally in the exchange? Time to trade. This is where the calculator you googled feels like a cruel joke. You see STAKE/USDT trading at, say, $1.20. You put in a market order, expecting roughly that. Nope. Slippage. Liquidity for STAKE isn\’t like Bitcoin. Your relatively small sell order might hit just fine. Or it might nudge the price down slightly because there aren\’t enough buy orders stacked up at that exact moment. You end up getting $1.18 per token. Or less. It feels like a hidden tax. Limit orders? Sure, you can set your price. But then you might wait. And wait. Watching the chart wiggle, hoping your number gets hit before you give up and lower it out of sheer impatience. Been there, watched the candles burn.

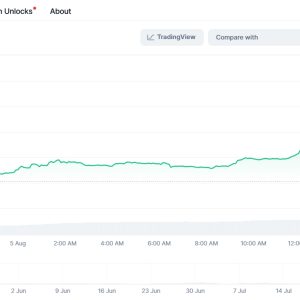

Say you traded STAKE for USDT. Stablecoin. Almost dollars! But not quite. Now you need to turn that USDT into actual USD in your bank. This is another layer. On some exchanges (like Coinbase, Kraken), you can often sell USDT directly for USD and withdraw to a linked bank account. But guess what? More verification usually. Link your bank account. Wait for micro-deposits to confirm (those 2-3 days feel like years). Then withdraw. Fees again. A flat fee? A percentage? Network fee? It adds up. Maybe you swap USDT for USD on the exchange, then use their card (like Crypto.com\’s). But then you\’re spending it, not getting cash. Maybe you send the USDT to PayPal (if your exchange and region support it). Faster sometimes, but PayPal\’s conversion rates from crypto to USD can be… unkind. It\’s a maze of mediocre options.

It feels like death by a thousand cuts. You start with $100 worth of STAKE. By the time it\’s spendable USD in your account? $70 feels like a win. It’s demoralizing. It makes you question the whole point. This isn\’t FUD; it\’s the mundane, grubby reality of bridging the crypto/fiat gap. Anyone telling you it\’s \”easy\” and \”seamless\” is selling something, or hasn\’t actually done it for small amounts recently. The system is built for whales, not minnows cashing out poker winnings.

Look, converting STAKE to spendable cash is fundamentally… messy. It\’s not one click. It involves hoops, waits, fees that feel like theft, and a fair bit of anxiety. The dream of frictionless cryptofiat is still mostly a dream for the average person cashing out small-to-medium amounts. It works, technically. But \”easy\”? Only compared to deciphering ancient hieroglyphics. It\’s a process steeped in minor frustrations and financial abrasion. You do it because you want the dollars, not because it\’s a pleasant experience. You endure the KYC, you curse the gas fees, you accept the haircut, and you hope the damn money shows up eventually. That\’s the real \”Easy Exchange Guide\”: manage your expectations, factor in the friction, and for the love of god, double-check every wallet address.