Okay, look. It\’s 2:37 AM. My third cup of coffee is lukewarm and tastes like regret. The glow of the monitor is the only light in the room, and I\’m staring at yet another crypto exchange interface. Why? Because after that absolute mess with QuadrigaCX years back – remember that? Ghost CEO, lost keys, millions gone poof? – and then the constant drip-drip of \”Oops, we got hacked\” headlines every other month, security isn\’t just a feature anymore. It\’s the only thing that lets me sleep, kinda. Mostly I still don\’t sleep. Hence the coffee.

So, I\’ve been poking, prodding, and frankly, stressing myself out testing BitGlobal for the past… week? Feels longer. It started because a buddy of mine, Dave – who once sent ETH to a Bitcoin address because he was half-asleep (we don\’t let him forget it) – wouldn\’t shut up about how \”solid\” their cold storage setup felt. Dave\’s not exactly a security guru, so that endorsement was… worrying. But it got me curious. Or maybe just desperate for something that didn\’t feel like storing cash in a paper bag on a busy street.

First thing that hits you? The KYC. Oh man, the KYC. It\’s… thorough. Like, \”please submit a notarized letter from your first-grade teacher confirming your identity\” thorough. Okay, maybe not that bad, but it felt invasive. I grumbled. I sighed. I took about seven attempts to get a selfie where my face didn\’t look like a confused potato under the harsh bathroom lights at midnight. It took hours. Partly my fault for starting late, partly their system being picky. Annoying? Absolutely. But then… that weird feeling settled in. The annoyance started mixing with this grudging sense of… relief? Like, if I had to jump through this many hoops, maybe, just maybe, the guy trying to impersonate me or launder something shady would just give up and go bother another platform. It’s friction, yeah, but friction that feels like a moat. A very annoying, well-lit moat.

Once I was in, the real test began. Depositing funds. The address generation felt… deliberate. Not instant. Like the system took a conscious, measurable moment to create it, tied specifically to me and that deposit, not just pulling from some giant shared pool. Small detail, maybe insignificant, but it felt different. More controlled. Less \”here\’s a random address, hope it works!\”

Then came the withdrawal test. The real gut-check moment. I sent a small, frankly embarrassing amount of BTC out to my personal wallet. My finger hovered over the button. That familiar twinge of \”is this it? Is this where it vanishes?\” kicked in. But the process itself was… methodical. Confirmations layered: email, 2FA, then this weird, slightly unnerving delay. Not a freeze, just a deliberate pause. I later learned it’s part of their multi-stage verification happening behind the scenes – automated checks, manual oversight triggers for certain parameters. It wasn’t instantaneous like some cowboy exchanges. It took maybe 15 minutes. Fifteen minutes where I stared at the screen, replaying every horror story I’d ever read. Then… ping. Email confirmation. TxID live on the blockchain. Funds arrived. The sheer, unadulterated relief was palpable. It wasn’t joy; it was the absence of dread. A novelty.

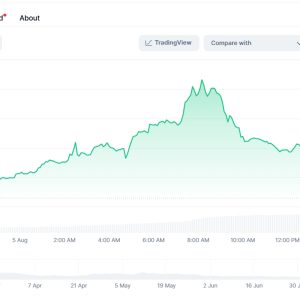

Trading itself? It’s… fine? Functional. The interface is clean, maybe a bit too clean for my liking – I miss the chaos of some older platforms, the information density. Order execution felt crisp, no noticeable slippage on my test trades (small potatoes, remember). Liquidity seemed decent for the majors. But honestly, after the security theatre of getting in and moving money, the actual trading felt almost mundane. The real story wasn\’t the speed of the trade; it was the fact that the assets felt present and mine to move. That’s the baseline that shouldn’t feel revolutionary, but sadly, it does.

The thing that genuinely impressed me, buried in the settings like a shy kid, was the granular security controls. It wasn\’t just \”turn 2FA on/off.\” It was: \”Set withdrawal whitelist addresses? Yes/No.\” \”Require email confirmation for every new device login, even after 2FA? Yes/No.\” \”Set daily withdrawal limits per token? Go ahead.\” \”Want transaction confirmations via multiple methods? Configure it.\” The level of control was… intense. Empowering, sure, but also a bit overwhelming. Like being handed the keys to a nuclear submarine\’s control panel when you just wanted to sail a dinghy. I spent a good hour tweaking things, locking it down tighter than Fort Knox. Felt good. Felt like I was building my own security, not just relying on theirs. That distinction matters.

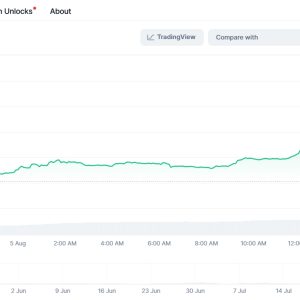

Oh, and the cold storage thing Dave mentioned? BitGlobal bangs on about it relentlessly. \”95%+ in cold storage!\” Okay, cool. How do I know? I don\’t, obviously. Not really. No user ever sees the vaults. But the way the hot wallet interactions work – the delays on large withdrawals, the multi-sig requirements hinted at in their documentation (buried deep, had to dig) – it feels congruent. It aligns with the friction. It’s not marketing fluff you can easily disprove with a quick test. It permeates the user experience. You feel the weight of the offline reserves in the slight pauses and the deliberate processes. It’s tangible in its indirectness.

Is it perfect? God, no. The fees aren\’t the absolute lowest out there. That friction I mentioned? It’s real. Sometimes you just wanna move fast, and BitGlobal makes you walk through treacle. The UI, while clean, lacks some advanced charting tools I occasionally crave. And that nagging voice in the back of my head? The one that says \”No platform is truly un-hackable, no custodian truly infallible\”? Yeah, that voice is still there. Louder sometimes, quieter after a successful, uneventful withdrawal. It’s the crypto condition.

So, after a week of late nights, lukewarm coffee, and simulated paranoia… would I park a significant chunk here? More than I would on… let’s say, half a dozen other platforms whose names rhyme with \”Binance\” or \”Mexc\” or whatever the flavor of the month is? Yeah. Probably. It’s not about blind trust. It’s about the sheer, observable effort they put into making theft and fuckery difficult. It’s about the controls they hand me. It feels less like gambling and more like… cautiously storing value. In this insane, volatile, often-scary world, that deliberate, slightly annoying friction? It’s starting to feel less like a burden and more like the price of a decent night\’s sleep. Maybe. We\’ll see. Ask me again after the next major exchange implosion headline. I\’ll probably be right here, at 3 AM, checking my whitelisted addresses.

FAQ

Q: Seriously, how long do withdrawals actually take? You mentioned 15 mins, but is that consistent?

A> Ugh, the waiting game. Look, it varies, okay? Small amounts, straightforward tokens? Sometimes it feels faster, like 5-10 mins. Larger sums, or sometimes just because their risk system flags something (who knows what?), it can crawl to 30 mins, even an hour. It\’s that multi-layer verification kicking in. The point is, it\’s never instant like throwing cash out the window. It\’s deliberate. Plan for it. Don\’t be trying to arb a fast-moving meme coin expecting lightning speed. It\’s built for safety, not speed trading. That delay is the sound of security working, however frustrating it is when you\’re staring at the screen.

Q: Are the fees really worth it for this \”security premium\”? Feels like I\’m paying extra just to feel safe.

A> Fair point. Yeah, the trading fees are… noticeable. Not highway robbery, but definitely higher than the pure discount brokers. And withdrawal fees? They exist, often network cost plus their bit. Is it worth it? Man, that\’s so personal. Remember Dave? He lost 0.5 ETH once on a sketchy platform because their \”low fees\” came with \”low security.\” Cost him way more than a year\’s worth of BitGlobal fees. For me, right now, with the amount I\’d consider holding there? Yeah, I\’ll grudgingly pay the toll. It\’s insurance against catastrophic loss. But if you\’re day-trading tiny amounts constantly? The fees will eat you alive. BitGlobal ain\’t built for that. It\’s for storing and moving value you care about not losing.

Q: You talked about control. Is all that security configuration actually necessary? Sounds complicated.

A> Necessary? Strictly speaking, no. You can just turn on basic 2FA and leave everything else default. It\’s probably still safer than many places. But… why wouldn\’t you? The whitelist? Takes 5 minutes to set up your main withdrawal addresses once. Then, even if someone does compromise your account, they can\’t drain it to some random wallet. Device confirmations? Annoying when you get a new phone, sure, but stops someone halfway across the world logging in instantly. The limits? Stops a thief cleaning you out in one go. It is extra steps. It is complexity. But it\’s complexity that puts you in the driver\’s seat. It transforms security from something the platform does to you, to something you actively do. Feels different. Empowering, even if it\’s a pain initially.

Q: Cold storage is great, but what about regulatory risk? Couldn\’t some government just seize it all?

A> Sigh. The million-dollar (or million-Bitcoin) question, isn\’t it? The cold storage locations? Deeply, deliberately opaque. Different jurisdictions, supposedly. Makes it harder for any one government to just swoop in and grab the keys. Is it foolproof? Absolutely not. If a powerful enough state actor really wants something, they usually find a way. BitGlobal\’s compliance is pretty stringent (hence the KYC nightmare), so they\’re likely following regulations in the places they can operate. But the whole point of the distributed, opaque cold storage is resilience against single points of failure, including regulatory seizure. It\’s a shield, not an impenetrable fortress. Nothing is. It just makes it significantly harder and messier for anyone trying to take it all down at once. That\’s the theory, anyway. We live in interesting times.