So, Seba Bank. Heard about it first time back in 2019 at some crypto meetup in Zurich – this guy in a wrinkled suit kept raving about \”finally, a real bank for Bitcoin bros.\” Honestly? Sounded like hype. After losing ETH to a dodgy exchange exit scam that same year, I’d developed this permanent twitch around anything claiming to \”secure\” crypto. But last winter, when FTX imploded and I watched six figures evaporate from a friend’s BlockFi account overnight? Yeah. That cold-sweat panic makes you reconsider things.

Walked into their Zurich branch near Bahnhofstrasse – all glass and brushed steel, smelled like money and anxiety. The security dude scanned my retinas like I was trying to smuggle state secrets. Felt excessive till I remembered Mt. Gox. Opening an account took three weeks. Paperwork pile thicker than my divorce docs. Annoying? Hell yes. But when the account manager – this sharp woman named Claudia who spoke four languages and actually understood UTXOs – explained how client assets sit in segregated, audited cold storage under Swiss banking law? My shoulders dropped two inches. Still, part of me whispered: Trust costs more than transaction fees.

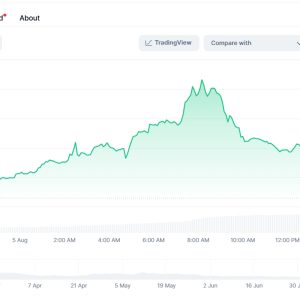

Tried their trading interface last April during that Bitcoin spike. Ugly truth: I’m impatient. Binance’s 100x leverage tempts me like tequila shots. Seba’s platform? Clean, almost boring. No flashy charts screaming \”YOLO DOGE.\” Executed a BTC/CHF trade. Settlement took 90 minutes. Ninety. Minutes. Nearly threw my laptop. But later, checking the blockchain explorer? Zero slippage. Funds landed in my fiat account before lunch. Realized I’d forgotten what \”on-chain confirmation\” felt like after years of IOU platforms. Weirdly… missed it.

Their lending desk approved a loan against my ETH stash for a property down payment. Here’s where Swiss conservatism bites: 50% LTV max. \”Mr. Davies, volatility requires caution,\” Claudia said, tapping her Montblanc pen. Contrast that with Celsius offering 90% LTV days before bankruptcy. Felt insulted getting half what crypto Twitter promised. Signed anyway. Sleeping beats dreaming of lambos.

Staking’s where friction hit. Wanted to stake DOT. Seba’s yield: 7%. Kraken offered 12%. Asked why the gap. \”Custodial slashing protection, insurance reserves, compliance checks,\” their PDF read. Translation: safety nets cost yield. Opted for Kraken. Lost sleep for weeks imagining validators misbehaving. Moved it back to Seba. That missing 5%? My sanity tax.

Got hacked once. Not Seba – my damn email. Some script kiddie in Minsk tried resetting my Seba password. Lockdown triggered instantly. Phone rang: Zurich number. \”We detected unusual activity. Confirm your identity.\” Recited backup codes while sweating through my shirt. Account frozen for 48 hours. Maddening? Absolutely. Also… profoundly relieving. Contrast that with Coinbase’s automated \”resolution in 5-7 business days\” bots. Sometimes bureaucracy feels like armor.

Fees. Oh god. 0.25% per trade? Withdrawal charges? Feels like being nibbled by piranhas. Complained to Claudia. She shrugged. \”Offshore exchanges charge less. They also vanish.\” Point taken. Still hurts paying $200 to move six figures when Uniswap costs pennies. But then I reread the terms: theft insurance covers even user credential compromises. Most platforms exclude that. Pays for itself? Ask me after the next hack.

Biggest cognitive dissonance? Calling it a \”crypto bank.\” Traditional banks hate volatility. Seba embraces it while building vaults. Watched them handle the 2022 Terra collapse – no halted withdrawals, just terse emails: \”UST exposure minimal due to risk parameters.\” No heroics. No \”trust us\” tweets. Just… banking. Weirdly anticlimactic for crypto. Maybe maturity feels boring.

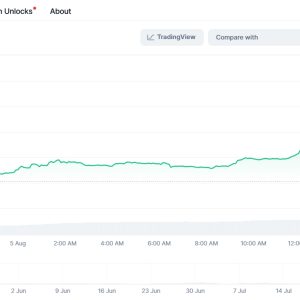

Now? I keep 70% of my stack there. Still trade elsewhere for thrills. Still curse their fees. But when macro winds howl and exchanges freeze? I log into that glacial interface. See balances untouched. Breathe. It’s not perfect. Just… human-grade safe. And right now? That’s enough. Maybe.

FAQ

Q: Is Seba Bank just for rich investors? Minimums?

A> Nah. Opened mine with €5K. Saw students funding accounts with monthly €500 buys. Big whales swim here too – private suites upstairs – but entry’s lower than Swiss private banks. Still, not Coinbase: expect paperwork. Took me three notarized docs.

Q: Can I spend crypto directly with their debit card?

A> Technically yes. Used it at a Barcelona tapas bar. Smooth until the bill came. Their system auto-converts crypto to EUR at point-of-sale. Got murdered by spread + fees. Felt like paying 15% for paella. Now I just top up the card with fiat. Crypto stays vaulted.

Q: How’re their yields compared to DeFi?

A> Laughably conservative. Staking ETH nets ~4% vs Lido’s 5%+. But when Celsius imploded, my Seba staked ETH kept earning. Trade-off’s brutal: safety or yield? I split the difference – play money in DeFi, core holdings here.

Q: What if Switzerland bans crypto?

A> Valid fear. Asked Claudia this. She smirked: \”We’re regulated like Credit Suisse. If crypto dies, your stocks die first.\” Swiss law recognizes crypto as assets. Still… politics shift. My contingency? 10% in a hardware wallet buried offline. Paranoia is portfolio management.

Q: Support any obscure altcoins?

A> Slow rollouts. Waited 18 months for ADA support. Forget meme coins. Their \”strategic asset review\” involves Swiss regulators nodding slowly. If it lacks institutional custody solutions? Not happening. I keep my Shiba Inu elsewhere. Regretfully.